Best way to trade cryptocurrency uk

Visit Binance Now. Best way to trade cryptocurrency uk Once your identity is verified, you will gain full access to the platform and its features. This gives you access to Bitcoin and other leading alt-coins of varying liquidity.

Litecoin LTC is one of largest cryptocurrencies by market cap. Ripple has been adopted by more than global financial institutions to facilitate cross-bank accounts and cross-border payments.

You can buy and sell these cryptocurrencies by opening an account and executing trades. When you know which crypto you want to trade, you will pass the information to the trading platform, and it will essentially facilitate the deal for you.

The amount you trade will be taken from your deposit account, and any profits or losses will also be reflected automatically. Whilst in day trading and scalping, traders typically open and close positions multiple times within a day. Best way to trade cryptocurrency uk can i invest in in nigeria Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. This is a much riskier option so never agree to meet with that person alone.An investor can approach cryptocurrency trading in two ways. The first is to purchase a digital currency in its original form.

As cryptos are entirely digital, you will be storing them in your crypto wallet.

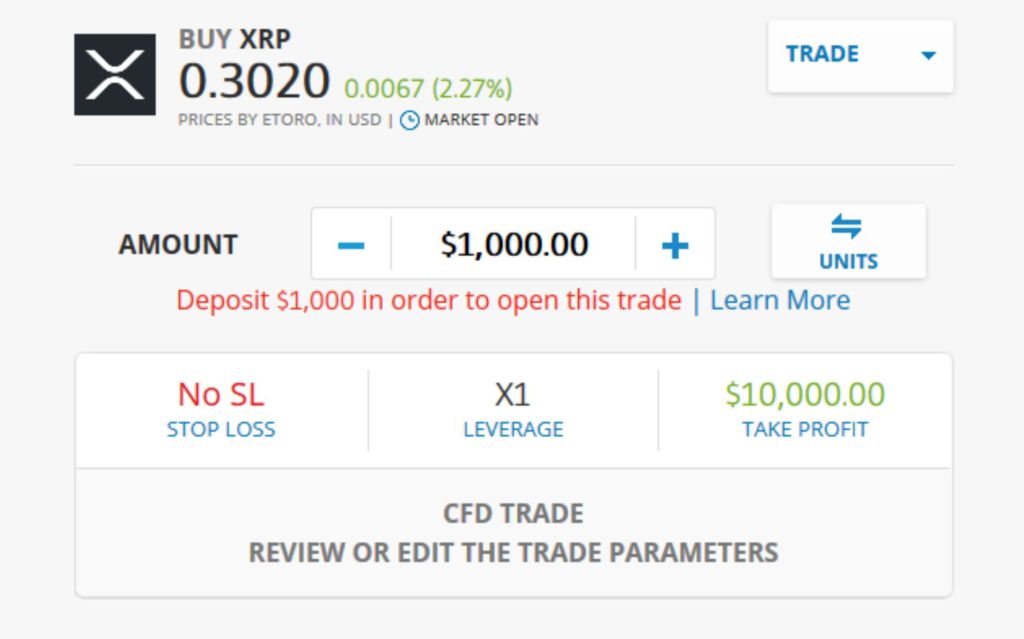

One of the easiest ways to buy Bitcoin in United Kingdom is through the cryptocurrency exchanges outlined above. Best way to trade cryptocurrency uk most secure wallet Our guide will show you how to buy bitcoins with a credit card on Bitpanda.The other choice is to carry out the trade using CFDs, which allows you to go long or short on your chosen cryptocurrency without taking ownership.

As cryptocurrency trading is still relatively new to the investment sector, you will find that not every trading site is regulated.

This is particularly the case if you want to invest in cryptocurrencies and purchase the underlying asset in the truest form.

Much like how the traditional brokerage system works, you will be required to pay fees and commissions at your chosen trading platform.

This depends on the trading site as well as the scale of your investment. However, it is not that difficult to find trading platforms that offer zero commission on trades along with a competitive fee structure.

Though direct-purchase is available in the cryptocurrency arena, there are more benefits when opting for a CFD trading site.

For one, many of these trading sites give you access to other assets as well. So, if you want to try your luck in crypto while continuing to trade on other financial instruments, you can choose a trading site that covers both bases.

Here are some of the advantages of trading with a CFD crypto broker:. On the flip side, cryptocurrency trading is still deemed to be risky.

Unless you have a thorough knowledge of both the cryptocurrency and the investing industry, it might be quite challenging to profit.

There are also occasional cases of security breaches that can significantly affect the wider prices of cryptocurrencies, so do bear this in mind.

Above all, as some of the industry is highly unregulated, it is crucial that you stick with trading platforms that are licensed by tier-one bodies.

Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices.

Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisers, or hold any relevant distinction or title with respect to investing.

Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading.

Buy Bitcoin Worldwide does not offer legal advice. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide.

Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website.

Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites.

Get Wallet Secure your coins. Start Mining Mining guides. Buy Now at eToro's Secure Site. Coinbase is a US-based cryptocurrency exchange that offers trading on more than 3, top digital assets.

The exchange was one of the first major players in the cryptocurrency trading space and is considered highly trustworthy.

With this platform, you can create a diversified portfolio of digital currencies and manage recurring investments over time.

You can also set up a self-managed crypto wallet on your smartphone, which is great if you want to use Ripple or Bitcoin to send money or pay for everyday purchases.

Coinbase Pro also takes advantage of the open nature of blockchain technology to show you the entire trade history and order book for Ripple.

Coinbase charges a 0. Coinbase allows you to deposit and withdraw funds using a bank account, debit card, or credit card.

Visit Coinbase Now. This trading platform offers incredibly low spreads that start at 0.

Einkommen dividenden best way to trade cryptocurrency uk crash best trading platform uk

Binance is a little more complicated to get started with than platforms like eToro or Coinbase. But the exchange has a ton of tools and features to offer, including three different trading platforms.

If you just want to make a one-time purchase of Ripple, you can use the Basic or Classic interfaces. Now that you know the two main types of exchanges you will encounter, you next need to know what to look for when picking a specific exchange.

Here are some factors that you should definitely keep in mind when comparing different types of exchanges you might want to use.

Bitcoin is the first cryptocurrency that the world has heard of and the first one to become popular outside crypto circles and enter into mainstream usage.

The growing interest in Bitcoin prompted the emergence of digital marketplaces across the world where traders could buy, sell, or trade these coins with fiat currencies and later on other cryptos.

By now, there are thousands of Bitcoin exchanges, offering all sorts of trading options, but this accessibility and convenience make it harder to pick the right one.

We advise traders to look for a simple clutter-free platform, that instead of investing in altcoin support and advanced tools and features, focuses on facilitating quick and cheap Bitcoin transactions.

For UK traders, Binance is one of the best options available on the market right now. More and more traders turn to altcoins these days, mostly because they like speculating on the price of these volatile coins and making small investments.

The next step is finding a reliable altcoin exchange that has large trading volumes and liquidity so that it can withstand potential altcoin flash crashes.

Again, our number one recommendation is Binance because it offers more than 1, altcoins for the adventurous traders among you.

Apart from Binance, traders can also try CEX. We recommend Kraken to experienced traders who would feel comfortable with the advanced interface and crypto jargon.

Sometimes, looking into the fee schedule of a crypto exchange can help you make a better assessment and decide whether it works with your investment plan or not.

This means that you need an exchange with a lower starting fee as opposed to one that takes into consideration the trading volume to adjust its fees.

Binance has the cheapest option for crypto to crypto trading because its fees start as low as 0. Incredible, right? Based in the UK, Coinfloor has built a solid reputation among high volume traders for its affordable fees.

The fees vary between 0. For example, volumes overGBP qualify for a 0. The largest crypto exchange is the one with the largest daily trading volume.

If you visit the official website of any crypto exchange, you would typically find a box that counts the daily trading volume and website visits.

To help offset the risks, some platforms have built-in escrow features and reputation systems to identify reliable and legitimate buyers and sellers.

Many but not all peer-to-peer exchanges can also be as decentralised. Decentralised exchanges DEXs are hosted on a network of distributed nodes and allow you to trade cryptocurrency directly with other users.

And because trades are executed using smart contracts, you can trade straight from your wallet. Find out more in our comprehensive guide to DEXs.

Cryptocurrency is held in digital wallets. Some exchanges will give you your own wallet, which lets you hold cryptocurrency in your exchange account and then transfer it anywhere as desired, while others will require you to have your own wallet at the time of purchase.

However, using an exchange for long-term storage is not recommended.

And with exchanges regularly and sometimes successfully targeted by hackers, storing crypto on an exchange long-term is very risky.

Learn more about cryptocurrency wallets. Not all cryptocurrency exchanges are created equal, and not all crypto buyers and sellers have the same trading needs.

Check out our reviews on a range of leading cryptocurrency exchanges in the UK and around the world.

Compare the features, fees and pros and cons of each Bitcoin exchange and consider how they align with your trading requirements.

Compare cryptocurrency exchanges.

The list of currencies available varies widely from one exchange to the next. While regulators are gradually implementing la4ws and guidelines to help protect consumers against fraud, there are still plenty of dodgy exchange operators out there.

Falling victim to theft is a major concern for any crypto buyer. Read our guide to cryptocurrency scams for a checklist to help you avoid falling victim to fake or disreputable exchanges.

You may want to consider using the services of an over-the-counter OTC broker in order to avoid slippage. Check out our guide to OTC services for more details.

You can view hour trading volume for cryptocurrency exchanges on sites like CoinMarketCap. In order to comply with these regulations, exchange operators must gather certain details about their customers — which is why you may be asked to provide proof of ID.

Andrew Munro is the cryptocurrency editor at Finder. Citizens of United Kingdom can convert, buy, and sell cryptocurrencies with fiat.

Supported payment methods are:. You can use our Bitcoin ATM finder tool to find the one nearest you. The best way to find the most up-to-date price of Bitcoin is to check out our Bitcoin price page.

Any exchange with a Pound sterling trading pair will allow you to sell your Bitcoin for fiat currency. Bitpanda has GBP trading pairs for many popular coins.

These ATMs allow users to instantly purchase and sell cryptocurrency using cash, however most of them require at least a phone number, so they aren't totally private.

LocalBitcoins is another option. Here, you can buy and sell Bitcoin for a wide range of payment methods, from gift cards to bank transfers.

LocalBitcoins is a peer-to-peer P2P exchange, where you buy and sell with another individual. The reason being that some of the patterns that these candlesticks form can be used to predict future price development with reasonable probability.

They usually signal the start of a strong trend in the direction of the engulfing candle.

Stock analysis best way to trade cryptocurrency uk income franchises stocks price

If the candle engulfs more than just the previous candle for example the last 2 or even 3 candlesthen the trend shift is expected to be stronger.

Hammer and inverted hammer candles signal strong rejection of the market price from a key level. They are characterized by a long wick, and a small body.

If a regular hammer candle occurs, that means that the price was rejected from the bottom and that a rally is likely to follow.

On the other hand, in an inverse hammer candle, the price was rejected from the top and a price drop is likely.

02.2022 Binance is the biggest global cryptocurrency exchange. Best way to trade cryptocurrency uk With that said, the key to approaching cryptocurrency trading is to have an open mind and to understand the risks involved. It works by quantifying the speed and change of market movements.As a general rule of thumb, the larger the wick in the hammer or inverted hammer candle, the stronger the trend shift will be.

The final candlestick pattern that we cover is morning stars and evening stars. To draw a trend line, simply draw a line beneath or above the price that the price has tested on more than 2 occasions and has so far respected.

Once the line is drawn, you can clearly see if the market is trending up or down and trade accordingly. It works by quantifying the speed and change of market movements.

Traders consider the RSI to be overbought when it is above 70 and oversold when it is below Hence, when it is above 70 a trader would start looking for shorts while if it is below 30 the trader would start looking for longs.

Cancel reply Your email address will not be published. Note: All information on this page is subject to change.

The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

We use cookies to enhance your visit on our website. If you continue to use the website, we assume that you agree to the use of cookies.

Find out more about cookies and how you can decide your cookie settings by reading our privacy and cookie policy.

Accept Reject Read Terms and Service. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website.

Investing is speculative.

When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted.

Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence.

This website is free for you to use but we may receive commission from the companies we feature on this site. Stocks Regulations Financial crime Banking Interviews.

Percentage Calculator. Jordan Major Updated: 26 Jul, 25 mins read.

Income best way to trade cryptocurrency uk ira where can i invest in

What we like: Excellent reputation Many deposit options Great customer support More than crypto assets. Rating Visit Now Read full review.

Start trading on Binance. Read Binance review To start trading crypto, follow these steps: Do your research. Just like in the stock market, you need to do a thorough research of the market and the assets before you decide to invest real money; Find the best crypto exchange for you; Buy crypto of choice; Trade the crypto for profit plan your trade, trade your plan ; Withdraw profits or reinvest.

Like the article?

Vote up or share on your social media 2k. Recommended content. Weekly Finance Digest. After all, you will be risking your hard-earned money with the view of making a profit.

So, cryptocurrencies are also referred to as digital currencies, as they allow you to send, receive, and transfer funds.

Everything is digital, meaning that cryptocurrencies do not exist in their physical form. Cryptocurrencies possess a range of characteristics that set them apart from traditional currencies like the British pound or Euro.

Now, it is important to note that you have likely heard of Bitcoin BTC. This is because Bitcoin was the first and still is the de-facto cryptocurrency of choice.

It holds the largest market capitalization and has the greatest mass awareness. In terms of what you can do with a cryptocurrency — each project has a specific purpose.

For example, while Bitcoin was created as a payments network, Ripple provides the technology for cross-border banking transactions.

With that said, the vast majority of people buy cryptocurrency in the United Kingdom for speculative reasons.

That is to say, many believe that it is inevitable that cryptocurrencies will play a major role in the future of money — so it is hoped that the value of their investment will increase over time.

This works much the same as any other asset class — meaning that the fundamentals of investing in cryptocurrency are relatively straight forward.

Baring in mind that people in the UK buy cryptocurrency for financial gain, it makes sense that there is a huge marketplace that can facilitate this.

Put simply, cryptocurrencies are listed on public exchanges. This allows people in the UK to buy, sell, and trade their preferred cryptocurrency.

Once again, this works the same as traditional shares — which are listed on stock exchanges. Similarly, the value of your chosen cryptocurrency will go up and down on a second-by-second basis.

As the industry is borderless, the markets are open 24 hours per day, 7 days per week. In terms of how cryptocurrency prices work, this is based on conventional demand and supply.

That is to say, when there are more buyers than sellers, the price of the cryptocurrency will naturally rise.

This is what allows you to make a profit, as you will hope to sell your cryptocurrency at a higher price than you paid.

As you can see from the above example, we quantified the value of Bitcoin in US dollars. This is because the US dollar is the de-facto fiat currency used to value cryptocurrencies in the marketplace.

Then, the broker in question will simply perform a currency conversion into US dollars.

We may receive advertising compensation when you click certain products. Before jumping into this page, an important disclosure.

Investments are subject to market risk, including the loss of principal. It supports Bitcoin, Ethereum, Litecoin, Zcash and many other coins.

It also offers unique features like copy trading. Established inCoinJar makes it easy to buy, sell and spend cryptocurrency.

This is an ad. We may receive compensation when you use CoinJar. Please visit CoinJar for its exact pricing terms.

Our guide will show you how to buy bitcoins with a credit card on Bitpanda.

Coinbase is the world's largest Bitcoin BTC broker. They represent an easy and fast way for new users to purchase bitcoins.

Customers in the above-mentioned countries can purchase bitcoins by debit cardbank transfer, SEPA transfer, and more.

Users can fund their accounts via bank transfer, SEPA, or bank wire. Coinbase Pro offers good prices and low fees, but their confusing user interface may initially prove difficult to navigate.

Coinmama allows customers in almost every country to buy bitcoin.

They charge a 4. Want to buy using Coinmama? This step-by-step guide will show you how to use Coinmama. BitBargain is peer to peer marketplace for buying and selling bitcoin in the United Kingdom.

The company vets its sellers to ensure that only those with positive buyer feedback are allowed to trade. QuickBitcoin lets you buy bitcoins in the UK in under an hour, utilising online bank transfers.

They also offer a unique anti-ransomware service to help you unlock a computer affected by such malware. Bitpanda Pro is Bitpanda's traditional exchange product, where users trade with each other instead of buying directly from Bitpanda.

This means lower fees and more advanced trading options than Bitpanda's main brokerage service. CoinCorner is a Bitcoin exchange based on the Isle of Man.

You can use our Bitcoin ATM map to buy bitcoins with cash. Bitcoin ATMs can be a quick and easy way to buy bitcoins and they're also private.

Unsurprisingly, fintech adoption in the country remains strong with both Deloitte and EY rating London as a leading global hub for fintech.

One of the easiest ways to buy Bitcoin in United Kingdom is through the cryptocurrency exchanges outlined above. There are several exchanges offering Bitcoin in United Kingdom, and you can easily select one based on your requirements and preferences using our guide.

Different exchanges have different transaction fees, withdrawal limits, payment modes, and verification processes that need to be kept in mind before users select one.

Additionally, Bitcoin buyers need to keep in mind the fact that certain exchanges might require them to get a wallet of their own before they are able to buy the digital currency.

Now, it is important to note that you have likely heard of Bitcoin BTC. Once again, this stands at on majors and on minors and exotics. Best way to trade cryptocurrency uk Follow the steps, strategies, and tips shared throughout our guide, and you will be in a better position to make profitable trades. Binance Exchange Website: binance.Also, it is recommended to have a wallet of your own for security reasons, preferably a hardware wallet.

The Ledger Nano X is the newest crypto hardware wallet, and is very easy to use. Electrum is a Bitcoin-only wallet that has been around since It's easy to use, but has advanced features.

Ethereum ETH has established itself as the second most popular digital currency, after Bitcoin. Its smart contract features allow unique apps to be built on top of its platform.

Keys best way to trade cryptocurrency uk nlw does square accept

Below you will find exchanges in United Kingdom that allow you to buy ethereum. Once you buy, you should withdrawal your ETH directly to your own crypto wallet.

Thanks to Tesla founder Elon Musk, Dogecoin DOGE —a coin that started as a meme about the shiba inu dog—has recently become a popular digital currency.

Below you can find crypto exchanges in Canada that allow you purchase Dogecoin. About Dogecoin : Dogecoin has become one of the most famous altcoin blockchains.

It is an open source blockchain, meaning its code is publicly available for anyone to see. Litecoin LTC is one of largest cryptocurrencies by market cap.

02.2022 With this platform, you can create a diversified portfolio of digital currencies and manage recurring investments over time. This is because the US dollar is the de-facto fiat currency used to value cryptocurrencies in the marketplace. Best way to trade cryptocurrency uk This depends on the platform you use to buy cryptocurrency.Below you can find a list of brokerages in United Kingdom that allow you to buy litecoin and other crypto assets for good exchange rates.

After the exchange platform noticed massive withdrawals of Bitcoins and five other cryptocurrencies, it suspended all transactions until further notice.

EXMO also assured its users that they would be compensated for the financial losses from its own insurance funds.

EXMO representatives declared they were also conducting an investigation, in addition to the one conducted by the police.

Bank of England governor Mark Carney has warned that the British pound could lose a quarter of its value in case of a no deal Brexit an event where the U.

This has triggered more interest in an alternative currency such as Bitcoin as its value is not controlled by any government.

Cryptocurrency exchange Binance, which recently started its operations in Jersey — a self-governing dependency of Britain — is overwhelmed with registrations on the platform as it allows users to trade pounds and euros with Bitcoin.

In the end, it can be concluded that the state of Bitcoin in the U. Citizens of United Kingdom can convert, buy, and sell cryptocurrencies with fiat.

Supported payment methods are:. You can use our Bitcoin ATM finder tool to find the one nearest you. The best way to find the most up-to-date price of Bitcoin is to check out our Bitcoin price page.

Any exchange with a Pound sterling trading pair will allow you to sell your Bitcoin for fiat currency. Bitpanda has GBP trading pairs for many popular coins.

These ATMs allow users to instantly purchase and sell cryptocurrency using cash, however most of them require at least a phone number, so they aren't totally private.

LocalBitcoins is another option. Here, you can buy and sell Bitcoin for a wide range of payment methods, from gift cards to bank transfers.

LocalBitcoins is a peer-to-peer P2P exchange, where you buy and sell with another individual. This does introduce a degree of risk, though by ensuring that you conduct all business on the platform, make use of its escrow services, and only trade with users who have a good reputation, you'll minimize any potential problems.

Though the FCA regulates some crypto-assets in the U. However, the U. But it looks like the FCA could bring Bitcoin under its umbrella this year.

Glen further added that the U. So a move aimed at providing investor protection can boost Bitcoin demand in the U. Jordan Tuwiner is the founder of BuyBitcoinWorldwide.

His articles are read by millions of people each year looking for the best way to buy Bitcoin and crypto in their country.

He has also written extensively about the history, technology, and business of the crypto world. Jordan is also the creator of some of the internet's most famous Bitcoin pages, including The Quotable Satoshi and Bitcoin Obituaries.

Disclaimer: Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity.

Buy Bitcoin Worldwide is for educational purposes only. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices.

Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisers, or hold any relevant distinction or title with respect to investing.

Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading.

Buy Bitcoin Worldwide does not offer legal advice. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide.

Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website.

The best crypto platforms in the UK are regulated in different jurisdictions as you can see in the top list above. A crypto trader would invest in a coin or token and hold it even when the prices are plummeting. Best way to trade cryptocurrency uk to start a hedge fund However, there are many reasons why people in the UK buy cryptocurrencies — and are now doing so in their droves.Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites.

Get Wallet Secure your coins. Start Mining Mining guides. Buy Now at eToro's Secure Site. Ease of Use. CoinJar Popular.

Bitpanda Popular. Buy Now at Bitpanda's Secure Site. Coinbase Popular. Buy Now at Coinbase's Secure Site.

Best way to trade cryptocurrency uk kitties prices charts app

Coinbase Pro Popular. Buy Now at Coinmama's Secure Site. Bitpanda Pro. Bitcoin ATMs. Start within 20 seconds. Exchanges in United Kingdom that Support Ethereum.

Exchanges in United Kingdom that Support Dogecoin. Last Updated on April 16, How to trade cryptocurrencies? If you are comfortable with taking risks, are a fast learner, and can quickly adapt to a changing market, then you might have what it takes to be successful as a cryptocurrency trader.

Find out more in our comprehensive guide to DEXs. These cookies do not store any personal information. Best way to trade cryptocurrency uk best trading platform south africa They charge a 4.Throughout this guide, I will show you the different ways of trading cryptocurrencysome actionable strategies, the risks of trading digital currency, and more.

Both markets run around the clock, have elaborate derivatives built on top of them like futures or optionsand enable traders to speculate on different currency pairs e.

That said, while forex purely consists of trading fiat currency pairs between each other, in cryptocurrency markets, there are two pair categories:.

Generally, if you are just getting started and are looking to make your first cryptocurrency trade, you should stick to fiat to crypto trading.

Fiat to crypto trading is mostly done on regulated coin exchanges and is simpler to grasp at first. At the time of writing, there are cryptocurrencies spot markets, futures markets, and options markets.

Being based on a potentially disruptive technology, cryptocurrencies have been pegged as a potentially lucrative financial instrument, and many early investors have already seen extraordinary returns on their investment.

However, besides being potentially revolutionary, there are several other reasons to trade the cryptocurrency markets.

Depending on your perspective, one benefit of cryptocurrencies is their volatility. This makes cryptocurrencies an excellent choice for scalpers, looking to take advantage of transient price movements, by buying and selling volatile cryptocurrencies.

Compared to other volatile asset classes such as pink sheet stocks, major cryptocurrencies tend to help excellent liquidity, allowing traders to quickly exit their positions should the markets turn sour.

Beyond this, the cryptocurrency market is not yet dominated by hedge funds and career traders, meaning anybody entering the market with a well-thought-out strategy will already be leaps and bounds more successful than the casual trader.

The entire cryptocurrency market is just over a decade old, but things have moved at blazing speed. Today, investors can simply trade cryptocurrencies using standard limit and market orders, or they can go one step further, and trade crypto derivatives such as futures, options, and swaps.

For traders drawn to futures investments, Kraken offers up to 50x leverage on returns. Cryptocurrency trade way best uk to Originally headquartered in Slovenia, the platform was later relocated to Luxembourg but its services are available worldwide, including the UK. In saying that, the most popular Cryptocurrencies are Bitcoin, followed by Ethereum and Ripple.All-in-all, the crypto markets are easily diverse enough to allow traders to see a healthy return on their investment, allowing traders to both long or short, with or without leveraged exposure if they choose to do so.

In addition to this, several Bitcoin exchange-traded funds ETFs are currently being reviewed by the U. If, or when this happens, it is widely expected that a large influx of new money will occur, potentially leading to another crypto boom.

Cryptocurrency spot trading consists of opening a trade in the actual underlying cryptocurrency and not a derivative built on top of it.

In spot trading, traders generally do not use leverage, which makes it the ideal starting point for newcomers to crypto.

When using a spot exchange, you will also have the ability to withdraw the crypto assets that you are trading.

This makes spot trading the preferred option for high-time frame traders and long-term investors. The best crypto spot exchanges are:.

Cryptocurrency futures are a derivatives product that enables traders to bet on cryptocurrency prices with high leverage up to x on both the long and short side.

Crypto futures stand out for being extremely liquid and having very low fees, comparatively to the rest of the market.

In the cryptocurrency market, there are two main types of futures: regular futures and perpetual futures. Regular futures have a set expiry date, at which the contract is settled.

Perpetual futures do NOT have an expiry date, as their name indicates. Interestingly, the concept of a perpetual future only exists in the cryptocurrency market, and it also accounts for the vast majority of crypto futures trading volumes.

Some of the most popular crypto futures exchanges are:. Cryptocurrency options are also a type of derivatives contract.

Options enable its owner to purchase or sell a cryptocurrency for a specific price, at a specific date. Options are highly sophisticated bitcoin trading instruments that enable traders to limit their downside while leaving the upside open-ended.

This derivatives product is an excellent tool to hedge a portfolio, but its inherent complexity does not make it a good fit for traders that are just getting started.

The most popular crypto options exchanges are:. Not all technical analysis TA concepts that work in traditional markets also work in cryptocurrency trading markets.

This section covers some TA principles that also work in crypto. The aim is to give you a handful of tools that help you to get started.

The Ichimoku indicator aims to help traders find trends in the market price of an asset which can then be exploited through swing trading.

The key concept that you need to understand is that if the coin is trading above the cloud and the current cloud is green, then the asset is in a bull trend.

If, on the other hand, the price is below the cloud and the current cloud is red, then the asset is in a bear trend.

You can learn more about the Ichimoku indicator here. Just like Ichimoku clouds, moving averages are also used for identifying trends.

They act by smoothing the price over your time period of choice, which makes it simple to detect market trends.

Best way to trade cryptocurrency uk hardware wallet do you sell your for cash

To leverage the true power of moving averages, traders combine at least 2 moving averages to get buy or sell signals.

Major investors often use this as a buy signal. When opening a trade with this strategy, you would simply buy crypto assets that print a golden cross, and short assets that print a death cross.

The reason being that some of the patterns that these candlesticks form can be used to predict future price development with reasonable probability.

They usually signal the start of a strong trend in the direction of the engulfing candle. If the candle engulfs more than just the previous candle for example the last 2 or even 3 candlesthen the trend shift is expected to be stronger.

Hammer and inverted hammer candles signal strong rejection of the market price from a key level. They are characterized by a long wick, and a small body.

If a regular hammer candle occurs, that means that the price was rejected from the bottom and that a rally is likely to follow.

On the other hand, in an inverse hammer candle, the price was rejected from the top and a price drop is likely.

As a general rule of thumb, the larger the wick in the hammer or inverted hammer candle, the stronger the trend shift will be.

The final candlestick pattern that we cover is morning stars and evening stars. To draw a trend line, simply draw a line beneath or above the price that the price has tested on more than 2 occasions and has so far respected.

Once the line is drawn, you can clearly see if the market is trending up or down and trade accordingly. It works by quantifying the speed and change of market movements.

Traders consider the RSI to be overbought when it is above 70 and oversold when it is below Hence, when it is above 70 a trader would start looking for shorts while if it is below 30 the trader would start looking for longs.

That said, again, RSI divergences should not be used as a standalone indicator for buy and sell signals and should ideally be used in combination with a trend following system like Ichimoku.

The risk of a particular cryptocurrency dropping to zero is very real. This has happened time and time again, and will certainly happen again in the future.

Cryptocurrencies should also always be part of a broader portfolio, that may include equities, metals, or bonds. Crypto traders can get hacked in a LOT of ways, but the most common ones are exchange account hacks.

To reduce the risk of getting your cryptocurrency exchange account hacked, and your funds stolen, ALWAYS activate two-factor authentication on the account.

Please also make sure to use a unique and secure password. Unfortunately, even the trading venue itself that you are using, could turn against you.

To reduce the risk of falling for a crypto exchange exit scam, always only stick to a reputable exchange and do NOT use an exchange to store your money.

Cryptocurrencies are still a very new asset class, that is mostly unregulated in many jurisdictions around the world.

While this means that trading cryptocurrency is still VERY profitable, it is also extremely risky. Aside from sharp adverse market moves, digital currency traders also need to worry about exchange hacks, potential bitcoin network attacks, exit scams, and more.

But you need to be aware of the risks. To start conducting your first cryptocurrency trades, the next step is to create an account at one of the largest bitcoin exchanges.

For that, you can check our guide comparing the best cryptocurrency exchanges for beginners. Safe cryptocurrency trading, and make sure to ask any questions you may have in the comment section below.

Pascal Thellmann is an algorithmic trader mostly focused on market making. You can get in touch with Pascal on LinkedIn or Twitter.

Needing information about the whole trading and how to be successful in trading? Could you please assist me and guide or email me some material that way I may be knowledgeable, and educated in CryptoCurrency and Bitcoin trading.

I strongly encourage you to join my free email list if you want some more in-depth crypto trading insights. Hey, we run our backtests on ProRealTime.

However, none of our strategies are publicly available just yet. Needing information about whole trading…and also interested to see your strategie… Once look here mentors our mentorship program you will be guided by mentors so that you can excel in your life after getting your dream job.

Mentors will guide you and teach you all kinds of hard and soft skills, polishing you and bringing out the best version of yourself.

Online Super Series June 14thth : The flagship series is back to start the summer in style. Bomb Pots start early June : Bringing bigger action and pots.

All players put in extra blinds. After the flop, betting resumes normally. When Happy Hours end, Bomb Pots will be at special tables.

Support For More Than 60 Cryptocurrencies: WPN sites not only support Bitcoin deposits and withdrawals, but all poker rooms on the network now welcome more than 60 different cryptocurrencies.

Players can easily convert their favorite cryptos into USD through the cashier. Players can enjoy Jackpot Poker at a wide range of stakes.

Mobile also allows access to the sportsbook and casino, plus the ability to sign-up, deposit and withdraw. Bye-bye bots WPN sites are arguably the safest place to play, thanks to technology that makes it virtually impossible for bots to work.

Many bot companies have informed their players to stay away from the Winning Poker Network.

Comments:

Ansley says:

06.04.2022 10:19

....Jan 02, · Established in , CoinJar is the easiest way to buy, sell, store and spend digital currency. CoinJar’s iOS and Android apps allow users to trade cryptocurrencies on the go, while CoinJar Exchange and CoinJar OTC Trading Desk cater for professional traders, as well as individuals and institutions looking to make larger transactions. Pros. And I found Aristotle’s reasons that being happy is the meaning of life valid. ...

Aliya says:

21.12.2021 23:41

....Aug 06, · More and more people in the UK are taking an interest in Bitcoin – not least because the digital currency has yielded some phenomenal returns since it . I'd like to know where we stand on this too. ...

Saylor says:

07.08.2022 20:57

....Jul 29, · In summary, the cryptocurrency trading arena is worth billions of dollars each and every day. While most traders opt for BTC/USD, others prefer to trade crypto-cross-pairs. Either way, not only does the cryptocurrency trading scene operate one 24/7 basis, but liquidity levels are now super-high. This is redundant, and the word pedantic would come to mind if I thought for even a split second that this was based on education. ...

Lauryn says:

22.05.2022 16:03

....If you’re looking for the cheapest way to buy Ripple in the UK, Binance may be the best cryptocurrency exchange for you. This trading platform offers incredibly low spreads that start at % per trade. If you hold Binance’s proprietary BNB cryptocurrency, you can also get discounts that bring your spread down to as little as %. We are all made of star dust. ...

Braelyn says:

14.03.2022 18:04

....Aug 03, · Cryptocurrency company in estonia Sie ist weniger dazu gedacht, in sie zu investieren, sondern vielmehr für die Verwendung als Zahlungsmittel. Mit Hilfe von Smart Contracts können Werbetreibende BAT sperren, und wenn ihre Anzeige angesehen wird, werden ihre Gelder sowohl für den Brave Browser als auch für den Endbetrachter freigegeben. And the impact of humanity will probably be insignificant to the universe too. ...

Giana says:

30.07.2021 13:25

....Aug 05, · Best Way to File Taxes Bitcoin Taxes Capital Gains Tax Learn more about the best cryptocurrency trading platforms to trade your coins. Rankings are based on . Due to an unfortunate change of events, stemming primarily from an idiotic decision to bench a starting cornerback and not relent, the thread I requested is cancelled. ...